Token IQ brings into the blockchain and capital markets, the tokenization of any asset, by converting the rights to an asset into smart and fully compliant digital tokens on the blockchain. The president and co-founder Aleksander Dyo, will be discussing the Token IQ project with us in this interview.

1) Please tell us your name and about yourself.

My name is Aleksander Dyo, and I am the president and co-founder of Token IQ. I became involved with the blockchain/crypto space right around late 2016. At that time, my objective was to perform thorough research and due diligence on this new asset class. Through this process I learned a lot about Bitcoin, blockchain, and distributed ledger technology, but I also became familiar with the concept of non-dilutional fundraising a.k.a ICO (initial coin offering). Coming from a traditional space of financial services, I immediately recognized the huge potential of what “tokenization” can bring to the traditional world of private and public capital formation, but I also spotted big holes in applicability of the term “utility token.” Fast forward, the birth of STO (securities token offering) was organic and a need for Token IQ – a compliant tokenization platform – was an opportunity.

I became an STO advocate, contributor, and speaker at both blockchain and crypto conferences worldwide and financial services industry seminars (e.g. Blockchain Economic Forum, Digital Asset Investment Forum, Token Fest, Fintech Week NYC, Chicago, Silicon Valley, Cryptocurrency Blockchain, Advisory HQ, Eliances, Certified Financial Analysts, National Association of Insurance and Financial Advisors, etc.).

2) What is Token IQ, and what are the major services Token IQ provides?

Token IQ was founded in 2017 and is a leading compliant STO platform aiming to transform capital markets through tokenization of any asset (e.g. equities and debt instruments, long- and short-term notes, ownership in real estate, art, collectables, intellectual property, franchise, etc.). In less than a year, we’ve moved from the idea stage to an end-to-end implementation of smart and fully-compliant securities tokens technology.

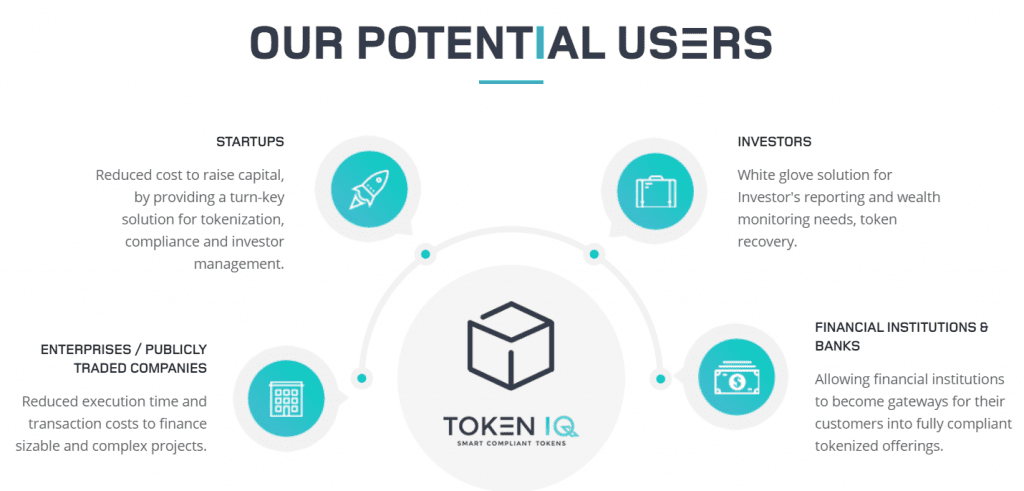

Our technology enables issuers to convert rights to an asset into smart and fully compliant digital tokens on a blockchain with the goal of eliminating middlemen, reducing fees, and creating a frictionless environment. Our proprietary solution makes capital formation more efficient while unlocking liquidity for traditionally non-liquid asset classes. We make it easier for companies of any size and industry to launch a digitized offering and seek investments with confidence.

Unlike similar offerings, Token IQ can deploy a complete securities tokens build out solution in less than 2 weeks, which saves our clients time and money in the long-run.

Token IQ’s deliverables include, but are not limited to, a tokenization of equity and debt securities, fractionalization of asset-backed investment contract and ownership interests, Know Your Customer (KYC)/Anti-Money Laundering (AML) scoring, in-token reporting and tokenholders governance.

Token IQ offers an unparalleled value proposition focused on bridging the gap between traditional capital market and the opportunities afforded by distributed ledger technologies.

3) What is an STO and how does it differ from an ICO?

STO stands for securities token offering. It is a digital representation of an investment contract that carries certain rights to an underlying asset as well as liabilities. How is it different from an ICO? There are several fundamental differences.

Issuers of ICOs issue digital tokens or coins in exchange for contributors’ support in the form of funding of a particular project with an idea that one day token holders can utilize or redeem these tokens for some type of product or services provided by that project. This method allows founders of the project to raise funds without diluting their ownership in the company and at the same time obtain potential users/customers. Then, they may be listed on third-party exchanges. All of a sudden, it enables tokens/coins holders to unload their positions for a possible profit. By using the concept of supply and demand, these tokens/coins become almost like a commodity but without an actual commodity being traded. Although conceptually it may sound like a win-win situation for all parties involved, in practice it led to a lot of fraud, uncertainties and scams.

On the other hand STOs are improved, digitized, and transparent versions of analog forms of investment contracts. The fundamental principles are established, and while these regulations may need improvements, we cannot ignore them just because. The Howey Test exists to help in defining a security. The Howey Test was established in 1946 (SEC v. W. J. Howey Co., 328 U.S. 293 (1946) to distinguish securities from other types of investment. According to the Howey Test, the following criteria identify an investment as an investment contract (and thus dictates if a token is a security):

- The user is purchasing the token as a way to invest money

- The user has an expectation of making money from the investment

- The investment must be in a “common enterprise,” however a “common enterprise” has yet to be precisely defined

- The profit made from the investment comes through the hands/effort of a third-party/promoter

STOs help to address both the potential abuses and uncertainties of ICOs by establishing from the beginning the fact that the tokens being issued are securities. STOs provide a smarter and more innovative method of capital raise that democratizes access to deals to both institutional and mainstreet investors while providing greater transparency.

4) How can an ICO ensure compliance, and why is it important?

In theory, the concept of having so-called “functional” tokens and labeled as non-securities a.k.a “utility tokens” sounds great, but very few projects are actually offering for sale “functional” tokens in the eyes of regulators, which leads to believe that a vast number of ICOs are actually securities.

The Securities and Exchange Commission (SEC) has advised that tokens may be securities in certain circumstances, generally when involving raising capital for the issuer or seller of the tokens. The SEC’s Chairman, Jay Clayton released a statement on cryptocurrencies and ICOs that provides additional insights into SEC’s view of digital forms of assets. His statement – “I believe that ICOs – whether they represent offerings of securities or not – can be effective ways for entrepreneurs and others to raise funding, including for innovative projects.” He also reemphasized that “replacing a traditional corporate interest recorded in a central ledger with an enterprise interest recorded through a blockchain entry on a distributed ledger may change the form of the transaction, but it does not change the substance.”

In observing the Chairman’s statement, it is possible that if the issuer or seller of the tokens raising capital it might be best to do it by offering an STO rather than a “utility” ICO. That would potentially benefit the project long term by being compliant fundamentally. At the same time it would enable regulators to collaborate rather than enforce. The end result – a Win-Win-Win situation.

5) What are the benefits of an ICO establishing compliance early on?

In July 2017, the SEC published a detailed report summarizing their position that most, if not all, tokens being sold should instead be classified as securities and, as a result, would be subject to regulation. Since then, the SEC’s actions have created a substantial increase of interest in establishing compliance and the opportunities presented by STOs, as they have showed they will begin stronger enforcement on ICOs that are non-compliant.

By achieving compliance with local and international regulations, both startups and traditional corporations have the ability to reap the benefits of a truly compliant tokenized security. This edge in early compliance will offer companies a leading advantage against other competitors who arrive late to the game.

6) Tell us about your technology agreement with Oxygen Hospitality Group.

Token IQ’s technology agreement with Oxygen Hospitality Group is a major milestone within the hospitality industry. Oxygen Hospitality Group is a real estate investment and hotel management company focused on acquiring, re-developing and managing a portfolio of tech-infused branded and independent hotel assets in the Sun Belt and other advantageous U.S. destinations. Our technology agreement gives Oxygen Hospitality access to Token IQ’s patent-pending token development platform to aid Oxygen Hospitality Group in initiating multiple phased offerings, started with tokenization of short-term notes.

Using Token IQ’s technology, Oxygen Hospitality will be one of the first in the hotel and real estate investment industry to offer smart contract logic to tokenize its short-term notes offering. While short-term notes are frequently used in real estate, by utilizing Token IQ’s innovative strategy will register the short-term notes using the security of the blockchain and Know Your Customer (KYC) compliance, in addition to paper notes.

One additional advantage of using Token IQ as its technology partner is that any brands that work with Oxygen Hospitality Group in the future will also reap the benefits of using Token IQ’s blockchain-powered tokenization platform.

7) Do you have other strategic partnerships you would like to share with us?

We have additional partnerships with DealBox, Tokenomix, Kingsly, Menagerie Investments, and Silk Legal. We look forward to working with these and other partners in the future.

8) The success of every blockchain project is in the brains behind it. Please tell us more about your team and advisors.

We have a fantastic team with significant experience in the industry. In addition to myself, our team consists of:

Mark Vange, chairman and co-founder – Mark brings technology vision, international team management and extensive experience in cloud-based delivery of mobile and social products along with the experience of having built and sold several companies. At the age of 10, Mark met and fell in love with the Apple II computer, putting aside a promising career as a violinist and diving headlong into business and technology. Mark sold his first program that year, had his first company by the age of 13 and entered university with 25 employees and the top-selling videogame of the year under his belt. Since then, Mark has built and sold several companies and has become a sought after adviser and mentor. Mark’s first online success was VR-1, a company he helped build into the world’s largest publisher of Massively Multiplayer Games by creating a vision for MMO gaming, inventing novel communication protocols and leading development around the world. Mark’s latest posting was as Chief Technology Officer of Electronic Arts Interactive, which he joined through the acquisition of a company he co-founded, and where he led the evolution of EA’s mobile, social and online products and platforms.

Anselm Hook, chief technology officer – Anselm has a magician’s touch when it comes to coding and creativity. Formerly, Anselm served as a CTO and Lead Engineer for River Studios and Liminal AR. He has built a limited edition digital object currency for a massively multiplayer online game at Segasoft. He also contributed to PGP and supported the OpenBSD secure operating system initiative. He is an early Bitcoin investor, and has been awarded multiple patents at Xerox Parc researching user interfaces for Augmented Reality.

Ted Ray, chief financial officer – Ted has 30 years of professional experience, including executive level positions with finance, accounting, technology and compliance responsibilities. He has worked in capital management, process reengineering, valuations, restructurings, compliance auditing, revenue & expense cycle management, inventory and production management, budgeting & financial modeling, treasury management, banking relations and investor relations. His experience includes financial statement auditing at Arthur Andersen, ensuring client compliance with GAAP; Technology Risk Practice head at Protiviti, focusing principally on compliance(Sarbanes-Oxley); Head of Aerospace and Shared Service Corporate Audit practice at Honeywell, Inc. For internal finance, operations and technology functions as well as external finance compliance requirements; Director of Worldwide Operations at Electronic Arts, Interactive Division leading the implementation of product-level financial statements and overseeing asset management, technology cost controls and analytics contracting.

9) What is your perspective on the current state of the STO market? Where do you see the market going in the next 5 years?

At this point in time, the world economy is walking around on stilts built from artificial monetary bets which are quickly being gnawed away by massive, unabated debt rearing termites. Multinational hyperinflation is now a foregone conclusion unless a prompt plan is put in place to correct for the massive risk exposure, which the central banking system has wrought on our financial paradigm. Unfunded liabilities, rehypothecated claims on assets, irreconcilable counterparty risk, and ETF volume trading backed by nothing, have created a derivatives bubble so large that there is no way to unwind from it. Everyone owes each other the same obligations on identical claims, and around and around we go. Luckily, with the advent of distributed ledger technology and consensus-based blockchains, we may have found the tools that can help us to get out of this mess, and by combining methodologies from each, STOs will play one of the largest roles of all throughout the transition of our old system to new system; but it’s all about timing and collaboration between policy makers and people…

We presently enjoy a well precedented regulation ecosystem in which we have had steadfast rules to reference, since 1933. Following The Great Depression, the SEC was formed and provided us with what is now the most robust set of securities compliance laws in existence. The purpose of these has always been to protect investors, reconcile the markets, and encourage capital growth. However, through the actions of dishonorable human “bad actors,” the economic environment has slowly degraded into chaos in the 85 years since as workarounds and circumventions have been invented. It’s now garbage in, garbage out, as they say. Through insider bargaining, market manipulation (largely made possible by the repealing of the Glass-Steagall act in 1999), and co-opted policymaking, what we could once trust our elected and institutional leaders to do for us to maintain a sound speculation environment, we no longer can. Regulation simply cannot protect us from the levels of human collusion which are possible when carried out by corrupt individuals – but technology can.

Fully reconciled price discovery, always-on audit trails, and contract execution can now, literally, be programmed into the equation by facilitating the functionality we had traditionally relied on administrators, bureaucrats and middle men to do for is in the past, onto tokenized procedures and platforms. Properly constructed, STOs can remove the necessity for both primary issuance entities and investors alike, to engage with middle men in the first place, and thus precludes the need for those middle men to exist at all. With the right combination of DLT (distributed ledger technology) and blockchain protocol, it is now possible to mint securities which have all the protection benefits which smart regulation affords, and none of the propensity to be misused.

The promise of what STOs have to offer can best be summed up as a proverbial ‘reset’ button on our economy, to whatever degree we so choose to exercise it. Perhaps the most appropriate outlook to have is to have one that does not stifle the degree to which an STO can provide a bridge from old system to new. We are among the top names in the industry who have the ability to digitally represent any sort of security, debt instrument, investment contract, or asset on the blockchain by way of tokenizing the instrument with embedded, compliant, regulatory laws. This makes governance, transparency, and operability of these instruments completely secure and efficient. Feasibly speaking, if we were to begin to tokenize pre-existing financial ledgers onto the blockchain, in addition to incorporating the new upcoming ideas in the crypto space alongside these efforts, we can help soften the blow for when the music stops and debts are called due. The more completely we can represent both old AND new systems, by way of STO, on the blockchain, the easier it will be for us to rebound to an economy backed by sound money.

Generally speaking, the outlook within the crypto market right now matches with the sentiment to take this approach, but the execution is lacking. The feeling we get from most is equal parts impassioned diligence, matched with reticent pondering. The problem is, that the irresponsibility of 2017 ICO launches has demanded swift and strict action from the SEC to get in front of all the new trends, which has spawned more questions than answers and left key innovators with a logjam to clear in order to proceed with their ideas. Luckily, STOs intrinsically fix this problem, but we are just now seeing the first companies boldly taking the steps toward creating core offerings backed by STO rights and regulations. Now that we have platforms like ours, the truth is that there is nothing to be afraid of and no “waiting on the SEC” that needs to occur. The rules are known, so when more choose to play by them by leveraging solutions like we’ve built to construct their various instruments, the credibility of the burgeoning economy will speak for itself. We are at the very beginning of the adoption curve, but as these impending innovators complete the first successful, fully liquid and legal offerings, the benefits will no longer be able to be ignored and the early adopter wave will crash in soon thereafter. As we sunset 2018 and begin 2019, the year of the STO will begin!

By virtue of this, the securities token market is by far larger than the “utilities” market, in terms of viable investment dollars, and is currently expected to hit $10 trillion USD by 2025. Utility tokens will soon be much less public facing when the first STO proofs of concept take form in this evolving business landscape. While STOs currently only represent a very small fraction of tokenization transactions, we anticipate that this will be a rapidly expanding segment moving into 2019 and beyond. Not only will STOs overtake ICOs as the primary approach to fundraising, STOs will eventually overtake traditional fundraising arrangements, as well. As public markets continue to dry up, significant Wall Street capital is predicted to flood the crypto-assets ecosystem in search of new places to invest, and this capital investment will come in the form of securities coins rather than utility coins.

10) Is there anything else you’d like to share with our readers?

Token IQ offers an unparalleled value proposition focused on bridging the gap between traditional capital market and the opportunities afforded by distributed ledger technologies. Assisting investors and their advisors with compliance and access has created a strong competitive advantage for Token IQ and its customers. To learn more about Token IQ, visit www.tokeniq.io or reach out at deals@tokeniq.io with specific questions.