Adoption has become a bit of a buzzword that is thrown around the cryptocurrency community. The truth is that the current rates of crypto adoption are laughably low. What many don’t like to talk about is how there have only been 24.6 million Bitcoin addresses ever created and that many Bitcoin owners hold more than one wallet address. Out of those 24.6 million wallets, 11.9 million of them hold less than 0.001 Bitcoin (less than $10). We currently share our planet with 7.7 billion souls and this means that there is only one Bitcoin wallet address for every 311 people in the world.

Yes, people like to talk about adoption and how it is coming. However, the truth is that we are a long way off from the mass adoption that is talked about and envisioned by so many members of the crypto community. Though the road to adoption is a murky one, it is safe to say that the cryptocurrency projects that solve the adoption puzzle and are adopted at scale will be the some of the best and most successful in the future.

In this article, we’ll look at three promising cryptocurrencies and give you the low down on how they are currently attempting to achieve mass adoption. Before you read on, you should be aware that no one truly knows which crypto projects will ultimately be mass adopted. Currently, everyone is in the same boat and trying to sail to the promised land of adoption without a map.

Dash

Dash is a semi-private cryptocurrency built using the Bitcoin code base by the project’s founder, Evan Duffield, to address three core shortcomings he observed in Bitcoin:

-

Governance

-

Privacy

-

Transaction speed

Over the years, Dash gained significant traction and is now firmly placed as a top 20 cryptocurrency. The cryptocurrency is now accepted by over 4,800 merchants and this is largely thanks to Dash’s one-second transaction speed and their merchant adoption efforts. Outside of Bitcoin, you’d be hard pressed to find another crypto project with the current merchant footprint of Dash.

The DASH project has adopted a merchant adoption strategy and has paid particular attention to widening its merchant footprint in emerging markets.

DASH in Colombia

Source: https://dashnews.org/dash-is-experiencing-rapid-adoption-and-use-in-colombia/

Throughout 2018, DASH adoption increased significantly with over 300 merchants accepting the crypto and there was a reported 25% growth in active wallets.

George Donnelly, Coordinator of Dash Colombia, highlighted how many of the newly onboarded merchants had never heard of cryptocurrency before or that DASH was the only coin they were aware of. Mr. Donnelly went on to say that

“I would estimate at least 90% of our merchants and event attendees have not heard of Bitcoin. Of course, Dash is brand new to them as well. The developing world is virgin territory for cryptocurrency. By committing to a developing-world strategy, Dash can dominate the regions where crypto is most apt to take hold first.”

George went on to say that many of the new merchants onboarded were restaurants and that he thought it was because they were used to industry rapidly evolving and were more open to embracing change. He then went on to explain that he thought commodities merchants, such as fuel vendors, were lagging in regards to crypto adoption because they cannot handle the volatility of crypto due to small profit margins. Mr. Donnelly went on to explain that this is why he thought Dash needed a crypto-to-fiat bridge to be able to onboard merchants in meaningful numbers.

Despite the issues highlighted, there can be little doubt that DASH is one of the most successful cryptocurrencies in Colombia when it comes to merchant adoption. Indeed, this is currently a common theme across developing markets currently.

DASH in Venezuela

Image source: https://www.ccn.com/dash-launches-text-based-crypto-payment-service-in-venezuela

It wasn’t long ago that DASH announced it had onboarded 800 merchants in Venezuela. This initial traction led to explosive growth and now more than 2,200 merchants accept DASH in the country.

The surge in the popularity of DASH can be attributed to the country’s political upheaval, hyperinflation and excellent merchant adoption execution by the local DASH team. In fact, DASH claim that their coin is the most used cryptocurrency for day to day use in Venezuela. Maybe this is not a surprise given the numerous photos comes out of Venezuela showing Dash adverts and the DASH evangelicals on the ground spreading the word about the project.

Few cryptocurrency projects have invested the resources to get boots on the ground and push the real world adoption of their cryptocurrency. Needless to say, many have been put off from pursuing adoption efforts in Venezuela due to safety concerns. However, DASH has seemingly bucked the trend and gained traction in a country where the native currency is almost unusable for regular transactions.

Venezuela has also been the testing ground for new DASH products such as DASH Text. This took the form of a pilot program at the San Antonio school in Caracas, with the goal of ensuring that children got their breakfast by sending $1 a day for a month. The distributed charity system allows people from around the world to send donations to the school and these donations are then equally distributed to the target recipients. Fifty children, who were deemed the most food insecure, were chosen for the scheme and the DASH team also taught the person who ran the school cafeteria how to accept DASH. The side benefit of DASH Text is that it also acts as a gateway for people in Venezuela to learn about DASH and adopt the crypto.

DASH Potential

DASH is already one of the leading cryptocurrencies and this is rightly so given their astonishing work in emerging market adoption. The cryptocurrency currently enjoys some of the fastest transaction speeds out there and is one of the most widely adopted cryptocurrencies by merchants. If you believe in the value of merchant market adoption then DASH is probably currently the front runner and is certainly a project worth following.

Nimiq

Nimiq is a cryptocurrency project which has gone somewhat under the radar in recent years. Team Nimiq is attempting to enable barrier-free value exchange for everyone and create the most accessible, censorship-resistant payment solution out there.

In essence, Nimiq is a peer-to-peer cryptocurrency like Bitcoin or Litecoin. However, we’ll jump into the differences between Nimiq and more established peer-to-peer currencies like Bitcoin and explain why Nimiq could have great potential to be adopted at scale.

Designed From The Ground Up To Be Easy To Use

For many years, the cryptocurrency markets were the home of geeks, cryptographers, and libertarians. These early users where exceptionally tech-savvy or were willing to invest a tremendous amount of effort into learning how to use crypto due to their political beliefs and what cryptocurrency stood for. The result was that ease of use wasn’t really seen as a priority and is the core reason why so many regular people find cryptocurrency so complicated. The interfaces were not really designed for a mass market and this is one of the key reasons behind the rise of crypto how-to websites like TotalCrypto.io and CoinBureau.com.

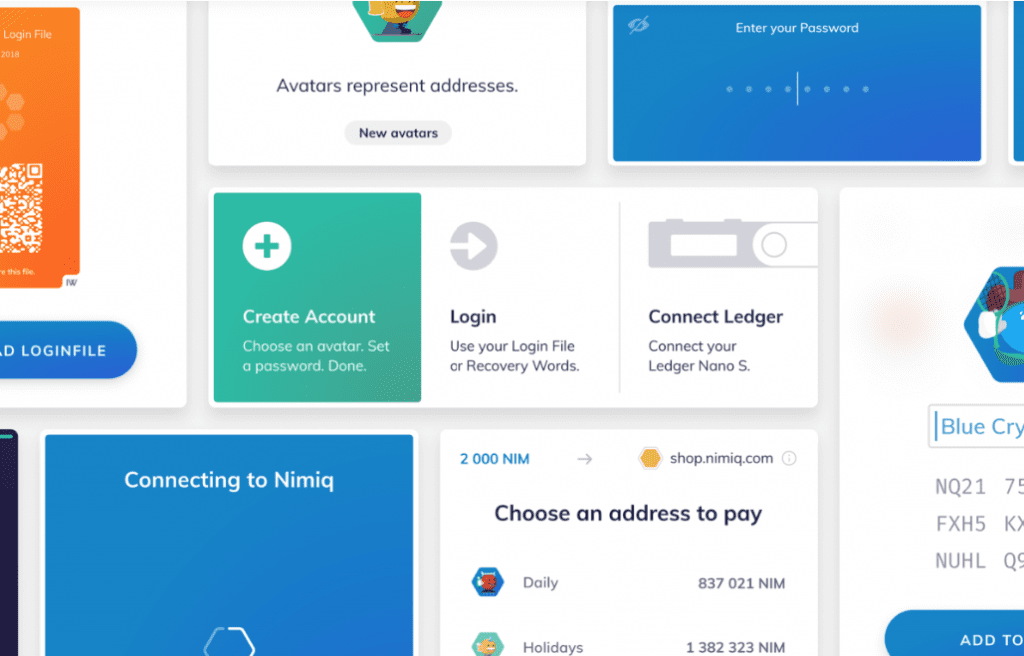

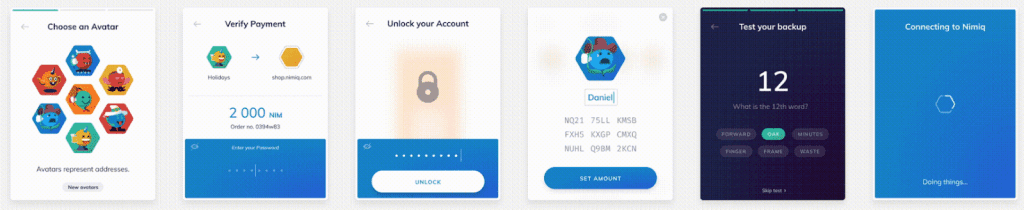

Anyone who has used an Apple product will probably understand the benefit of slick, intuitive and easy user-flows for the mass market. Nimiq has taken a similar approach when it comes to designing a cryptocurrency for mass adoption. From the ground up, Nimiq has attempted to make things as simple and as intuitive as possible for users. Recently, Nimiq has updated its onboarding interfaces to make it easier to create a Nimiq account than a Google one. This ease of use has been partly achieved by Nimiq’s browser-first approach, which means that users can connect to the Nimiq blockchain using nothing more than a web browser. The result is that Nimiq users can bypass annoying and lengthy downloads. Try it out for yourself and see how you can create a Nimiq account in seconds.

In a nutshell, Nimiq has been designed with mass adoption in mind and making things as easy for the user as possible. This contrasts with more established cryptocurrency projects like Bitcoin and Ethereum, which can take several minutes for the user to be successfully onboarded and usually require users to read through extensive ‘how to set up’ guides. Nimiq’s focus on simplicity and convenience has been taken with mass adoption in mind and this makes the project one worthy of following if you believe that these attributes are important for the wider adoption of any cryptocurrency. You can follow Nimiq’s developments on their official Medium blog.

Developer Adoption

Put simply, no cryptocurrency team can create a mass adopted payment ecosystem themselves. This is why community developers are one of the biggest focuses for projects and Nimiq is no different. Nimiq is implemented in the coding languages Rust and JavaScript, which are very common so that developers can build on it easily. In just three lines of code, a developer can connect any web application to the Nimiq blockchain, which makes Nimiq exceptionally easy to use for internet businesses and web-based projects.

JavaScript is the most common programming language in the world and Nimiq’s adoption of it makes Nimiq one of the easiest crypto projects for developers to adopt.

The Importance of Mobile Adoption

Image sourceL http://xmontheway.com/survival-tips-for-travelling-in-china/

Trends are changing when it comes to digital payment systems. Traditional payments systems have recently seen a surge in mobile payments. This shift has been enabled reliable and safe mobile payment infrastructure and has allowed users to experience a signficantly more convenient method of paying for things.

When it comes to the adoption of crypto payment systems, it is safe to say that what is offered needs to be better than traditional payment systems. So many people are now used to paying for things on their mobile that it seems unlikely crypto payment systems will ever be adopted on the same scale unless they are mobile friendly.

Nimiq’s browser-first approach to blockchain has meant that no large downloads are required, enabling users to transact value even in areas of low connectivity. This is a massive advantage given that even in developed countries like the UK, around 33% of the population suffers from poor mobile connectivity. Needless to say, this percentage only increases in less developed countries.

The trend towards mobile payments is a very real one and has been recognized by the Nimiq team. This is one of the core reasons why their browser-first approach could have significant value and spur on wider cryptocurrency adoption.

Co-existence of Fiat & Crypto

Some people believe that crypto will replace fiat overnight. However, one of the most likely outcomes is that crypto and fiat will co-exist side by side for a significant amount of time. One of the main problems facing the crypto universe is the ability to transact value between the crypto and traditional banking systems. The reason why this matters for adoption is that the overwhelming majority of business owns still denominate all their costs in fiat. This means that most businesses that consider accepting crypto as a payment method are forced to convert any crypto received into fiat to cover operating costs or the cost of item procurement.

The problem for merchants is that there is currently no easy and convenient way to convert cryptocurrencies to fiat, without using a crypto payment processor. Fees for these services can be as high as 5% and once you consider that most online merchants operate off margins as low as 0.5% to 3% it’s quite easy to see why the merchant adoption rate of cryptocurrencies is so low.

Nimiq is attempting to tackle this issue with Nimiq OASIS, which is a blueprint for a potentially revolutionary crypto-to-fiat bridge. This initiative is being pursued with WEG Bank and the non-custodial exchange Agora.Trade.

In a nutshell, Nimiq’s innovative approach focuses on making fiat currency blockchain compatible (EUR, USD, GBP) and to behave as if it were on a blockchain. This could provide a completely new way to transfer value between the crypto universe and the traditional banking network. The first version of Nimiq OASIS is set to support EUR, BTC, ETH, and NIM. You can read more about Nimiq OASIS in the team’s blog post.

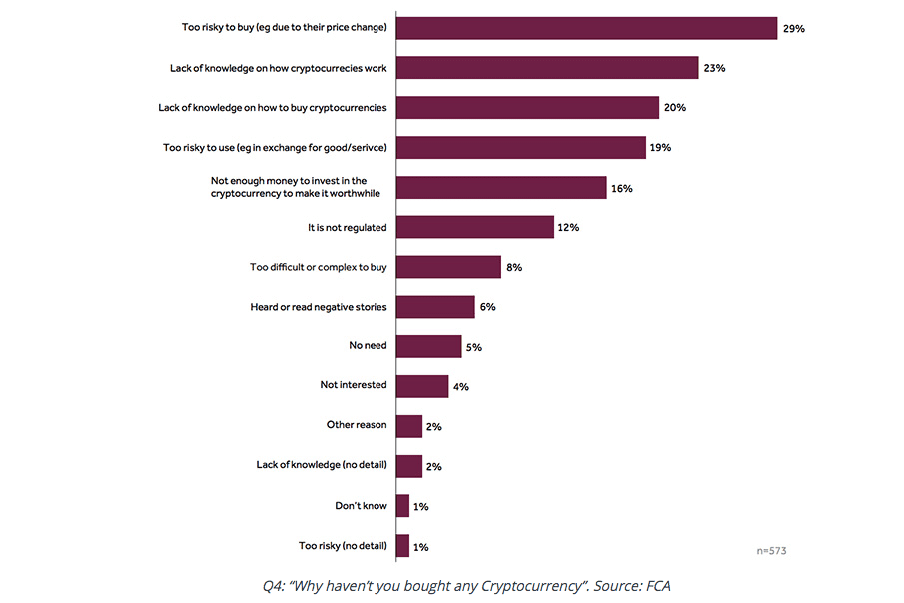

The potential benefits of Nimiq OASIS go further than merchant adoption. Because WEG bank allows access to the SEPA instant network, this means that the combination of Nimiq OASIS, Agora.Trade and WEG Bank could enable customers at any of the over 2,000 banks in the SEPA Instant network to conveniently transfer value between crypto and fiat. This could be huge for retail adoption of crypto, given that a recent FCA study highlighted that 30% of respondents claimed that the difficulty of buying crypto was the main reason they didn’t own any.

Although Nimiq OASIS is just a blueprint right now, the Nimiq Team has made a big statement of intent by acquiring a 9.9% stake in WEG bank. The target go-live date of Nimiq OASIS is Q4 2019. Team Nimiq is also looking to combine Nimiq OASIS with a liquidity trader to ensure that merchants do not have slippage problems when accepting crypto. This means that merchants using Nimiq’s solution can allow crypto users to pay for items with BTC, ETH, and NIM whilst the merchant benefits from knowing the amount of fiat they will get. This merchant round trip could potentially play a key role in widening merchant adoption of cryptocurrencies through giving merchants a lower cost alternative to payment processors to hedge against crypto price volatility and doing so at a lower cost than currently crypto payment processors. The result is that it should become viable for merchants with lower profit margins to accept popular cryptocurrencies.

Crypto Adoption In Emerging Markets

Nimiq’s adoption efforts have also extended beyond purely technical solutions. The project is also deeply interested in learning more about how to achieve mass adoption of crypto in developing communities and nations. This resulted in Nimiq sponsoring TotalCrypto.io to create a crypto adoption methodology on behalf of Nimiq. The key thing here is that the extensive proposal is entirely open sourced and any crypto enthusiast or project is free to use it to develop their own crypto adoption blueprints.

The proposal outlines a case study approach to crypto adoption and the idea is that a scalable blueprint should be created to deploy future case studies. This is composed of three core components:

-

Geo-targeted crypto airdrop: Aimed at sowing the seeds of free enterprise and giving locals the choice of how to spend their crypto. The idea is that this would act as a one-time stimulus package for the local economy.

-

Local exchange: To enable locals to swap native currency for crypto and vice versa. The proposal recommends that the exchange should also act as a crypto information center to educate the local community about cryptocurrencies.

-

Incubator: Has been proposed to up-skill locals, give them access to the tools and resources to create online businesses and participate in the global digital economy. This mechanism provides a way for new money to enter the local economy and enable economic growth. It has been proposed that crypto would be used as the base currency for these businesses and that incubees would have their salaries paid in crypto. All this is to help deepen the levels of crypto adoption in the case study location.

To read more about the crypto adoption proposal go to CryptoAdoption.io.

Nimiq’s Potential

Nimiq could be one of the most under-appreciated crypto projects when it comes to the impact it could have on wider crypto adoption. It is rare for any crypto project to be focusing on so many facets of adoption and these ambitions appear to backed up with serious substance. For example, the acquisition of a stake in WEG Bank acts as a massive statement of intent for Nimiq OASIS and the merchant round trip.

The project appears to have been quietly building through 2018/2019 and it seems likely that the launch of Nimiq OASIS will truly put the project on the crypto map. The application of this technology to solve the merchant round trip problem could solve a massive pain point plaguing many merchants which are considering the possibility of accepting cryptocurrency. Moreover, the cost to transact NIM is less than a cent, making it one of the lowest fee cryptos out there. Don’t be surprised if you start hearing more about Nimiq in the near future.

Jobchain

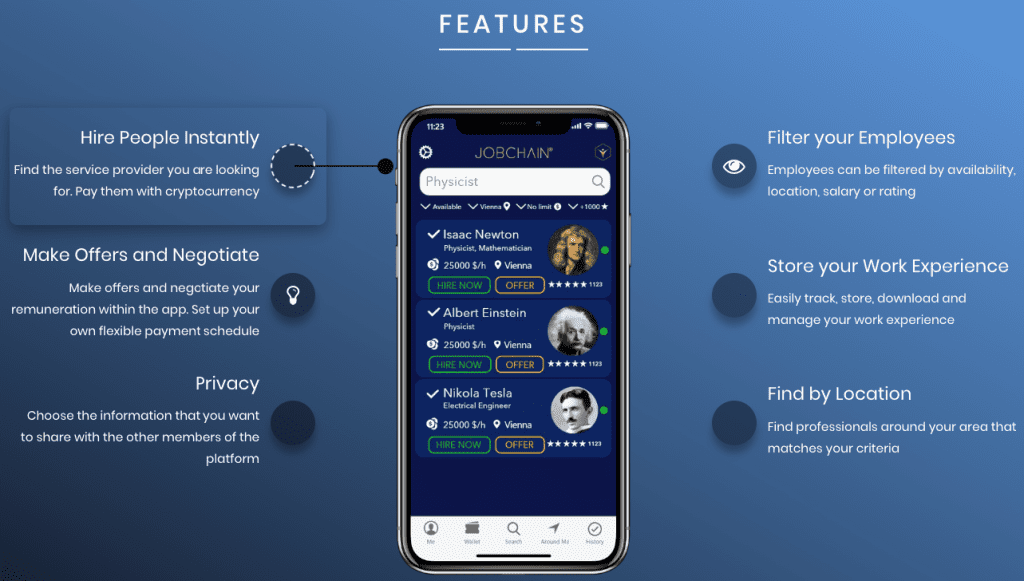

Currently what is missing in the cryptocurrency space is that killer dapp which goes mainstream. Right now, the most popular dapps are typically games, crypto gambling or cryptocurrency exchanges. Yes, there has been some progress in the last year in terms of dapp user numbers. However, the most popular dapp right now is called ADM and attracts only 12,000 per day. Now, this is truly an impressive number of users in the crypto space, but it falls way short of the mark when it comes to being a killer app that ushers in mainstream mass adoption.

JobChain is an early stage crypto project which aims to create that killer app by connecting freelancers looking to be hired with entrepreneurs wanting to expand their teams and outsource certain business functions. Most of us have regular jobs and are unaware of the growing freelance market. However, a recent report by Morgan Stanley Research revealed that within just ten years, freelance workers could make up 50% of the US workforce. The age of the regular nine to five with a single employer does appear to be under threat with the recent rise of the gig economy and freelancers. The freelancing platform, Upwork, has over 17 million registered users and one of their competitors, Fiverr, boasts 14 million users. In a nutshell, JobChain is looking to compete in a market in which the top platforms already have 10+ million users and where researchers anticipate significant market growth in the near future.

JobChain Vs UpWork & Fiveer

Most of you will be familiar with the argument that cryptocurrencies act as a store and transfer of value and are perfect for low-fee cross-border payments. What JobChain have done is to identify a market where there is already substantial demand and which is projected to grow signficantly in the future. The exciting thing about this market is that cross-border payments are exceptionally common on freelancer platforms like UpWork and Fiveer. Indeed, many smaller business owners, in developed countries, use these platforms to find remote workers who can execute tasks for less than the rate demanded by local workers. This phenomenon of outsourcing leads to freelancing platforms processing high volumes of expensive cross-border payments.

Many of you will be wondering why we need a crypto-based solution like JobChain. Put very simply, one of the main value propositions is the ability to reduce fees. Currently, UpWork charges 3% to 10% in fees for payment processing, payments to freelancers and administration fees. The worst part of this is that it doesn’t even account for extra fees that can be levied by the likes of PayPal or currency conversion costs. The truth of the matter is that if you are hiring or operating as a freelancer on the likes of UpWork, then you must be prepared to face exceptionally high fees to use such platforms. The JobChain hiring and freelancing app aims to solve this pain point by offering low-fee alternative by leveraging crypto for cross-border transactions within the app.

JobChain Vs Traditional Recruitment Agents

Image source: http://www.magazine.etnfocus.com/2017/01/03/student-recruitment-agents/

One of the reasons why the freelance economy and platforms like UpWork have been on the rise is due to the extortionate fees charged by traditional recruitment agents. Many of you who have changed job will have dealt with a recruitment agency and we’d imagine that many of you came away thinking that they were incredibly helpful.

What most people do not know is that recruitment agencies typically charge 15% to 30% of the candidates annual salary for matching the employee with the employer. That’s right; if you secured a job with an annual salary of $60,000 then the recruitment agent collected $9,000 to $18,000 in fees. The worst part of this is that the employer pays this fee and still decided to hire you on the agreed salary. The point is that this layer of fees that could have gone to the employee and is one of the reasons why freelancers can earn more money than those on salary.

More Than Just a Hiring Platform

The vision for the JobChain platform is more than just a hiring platform. The wallet app is set to enable users to buy, earn, sell transfer, store and rent different types of assets in addition to regular cryptocurrencies. This includes:

-

The ability to buy and sell cryptocurrencies.

-

Earn Job tokens.

-

Receive and send cryptocurrencies.

-

Store ownership contracts for physical assets (such as property and land).

-

Enable users to buy or sell tokenized physical assets.

-

Store licenses, certificates and degrees etc.

-

Store the users work experience record.

This means that the JobChain hiring platform can be viewed as a gateway to introduce a whole new type of person to cryptocurrencies and tokenized assets. The initial draw to the platform is envisioned be a cheaper and more efficient version of UpWork with added features like the ability to verify certificate and degrees of prospective candidates.

In countries like India, fake degrees are big business with a single gang operating out of New Delhi in 2019 allegedly selling more than 50,000 forged marksheets and degrees. Naturally, this poses a massive problem for employers in India attempting to verify if a candidates degree is legitimate or not. JobChain’s application of blockchain technology could be the very solution that employers in India need to combat the ever-growing problem of forged qualifications.

The Potential Of JobChain

Jobchain could be that killer app that acts as a gateway to wider crypto adoption. The project has focused on an already substantial market which is set for explosive growth in the coming years. The team at JobChain appear to have looked at the market and identified the high fees of existing non-crypto platforms as a pain point. The strategy of enabling lower fees by using crypto for cross-border payments has been combined with a crypto exchange, crypto-asset wallet, the ability to store tokenized physical assets, work experience records and degrees on the blockchain. All this aims to provide a one-stop shop to business owners and freelancers alike and could potentially challenge the likes of UpWork and Fiveer with the added benefits and features that the JobChain team is attempting to execute.

Although the project is in its early stages, the potential seems to be there to make JobChain worthy of being one of the projects to add to your watchlist. Ultimately the success of the project will depend on the ability of the team to execute and scale this grand vision.

Conclusion

Image source: https://www.weforum.org/agenda/2016/05/2-billion-people-worldwide-are-unbanked-heres-how-to-change-this

All the projects listed here are taking different approaches to adoption and are at different stages of execution. DASH is the most mature and well-known project and has already gained significant traction, particularly in emerging market adoption. However, the road ahead is still a long and hard one and even though the number of merchants is high, the vast majority of businesses in emerging markets still do not accept cryptocurrency for payments. George Donnelly, Coordinator of Dash Colombia could be correct when he hinted that a crypto-to-fiat bridge could be needed to onboard merchants in meaningful numbers. The interesting thing is that Nimiq is building that very solution in collaboration with WEG Bank and this just goes to highlight how meaningful an impact Nimiq OASIS could have on crypto merchant adoption.

JobChain is certainly the least mature of the three projects. However, the team is targetting a niche where the use of crypto actually makes a lot of sense. The cross border nature of hiring freelancers and the high fees currently charged by traditional platforms means that the platform is trying to address a very real pain point. This, combined with projected future working trends, means that if JobChain can execute it has the potential to be the killer app that the crypto space is currently searching for.

Finally, a kind reminder that no one knows the future of cryptocurrency adoption. You should instead treat these types of articles as guides pointing you in the direction of interesting projects and do your own research.

To adoption and beyond.

Disclaimer: The author holds some NIM in their portfolio and is compensated in a long-term independent consulting capacity by Nimiq. This article must not be construed as investment advice. Always do your own research.