Ever had a friend or a business associate of yours asking to borrow money? Do you remember the kind of thoughts and scenarios that played in your mind before you chose to lend money or to decline the request? You were weighing the risks. The same thing applies in commercial lending but lately, a lot of that thinking and evaluation is aided by lending automation software like that of TurnKey Lender.

Artificial Intelligence is applied in the financial industry to help businesses make faster and more informed decisions on loan repayments. The biggest talk around the use of AI in loan processing has been about whether it can replace humans in the process and whether the algorithms will be fair or not.

AI simplifies and fastens the borrowing process

With AI capabilities, it is very easy to process small loans much faster than it would be if the whole process relied fully on humans. For example, repeat borrowers can have their repayment history calculated in a much faster way simply by analyzing a database that contains the timelines of repayments. Serial defaulters can in that way be screened out or just have lower ratings even if they get their requests approved. Algorithms can analyze your money wallet (the account that you hold with the lender) and fast-track the process needed to check how credit-worthy you are for that particular lender.

The AI applied in lending software is programmed to sift through different kinds of information that you would have to provide to the lender. For example, it can tell how often someone borrows money and match that with the sizes and frequency of their repayment installments. This can help the AI engine guess the kind of income budget that a borrower allocates to repaying his loans. Over time, this omits the biases like race, profession, age, and the reasons for borrowing which were previously used in manual credit evaluation. In that case, the AI does not make the decision autonomously but it only makes recommendations based on a set of predetermined parameters.

Less red tape often translates to lower costs to the lender

Reducing the amount of red tape while still being able to give loans to borrowers with good credit ratings helps the lender reduce costs. Before the widespread use of AI in loan processing, the lending businesses had to hire more financial professionals for specific roles in origination and servicing and that meant higher payroll costs in. The accuracy of the information collected and analyzed through AI as a result of the first loan also helps lenders prevent the likelihood of losing more money by offering loans to people with repeat default history. They can actually recover the money lost through first-time defaulters by offering larger loans to a repeat borrower.

AI can effectively filter borrowers through social media behavioral traits

A good number of lending apps usually request partial access to one’s social media profiles and some communication history like SMS messages from other lenders or mobile wallets. There have been many divergent views regarding this practice. There are people who find it too intrusive and unnecessary while some others do not see any problem if it is all that stands between them and a loan at a good rate. Most lenders hold the view that linking a social media profile that matches the name of the account is a way of telling if you are dealing with a real borrower. Conflicting information such as address, marital status and the number of dependents can easily be figured out through AI.

Related article: Data analytics is important, but can you afford it?

The reality, in the end, is that using AI or even manual scraping someone’s social media profile is not always accurate but it will give a lender that extra edge to make the right call. It would be much more convenient for the borrower than having to sit through an interview or fill in forms that take forever to get someone’s loan approved. Microloans of $100 to $1000 are often for emergency purposes and it would be a disservice to have these types of loans taking more than a day to approve. On a lighter note, lending software users shouldn’t worry about having social media pictures that depict living beyond their means as only biodata such as birthdays, marital status and names is needed.

Some success stories of apps that use AI

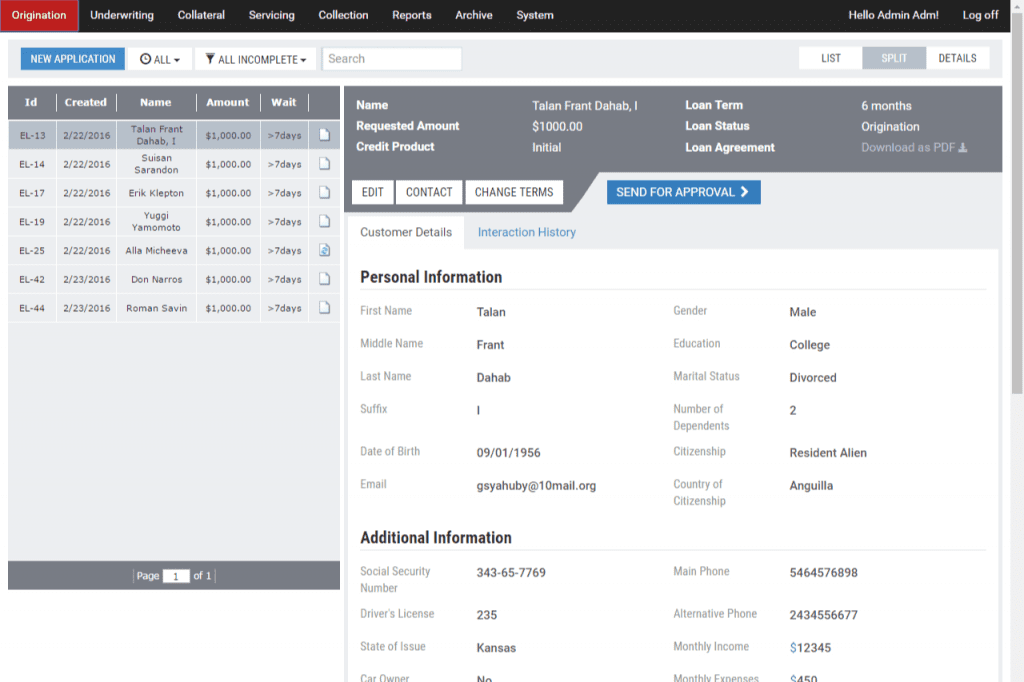

There already are awesome lending automation applications that can run risk evaluation and user scoring in under two minutes. The company pioneering in that domain would be TurnKey Lender which provides the most accurate statistics, processes requests quickly, and is extremely affordable, especially when compared alternatives. Most of the human input is only required during repayment reminders and when there is a need to address a technical support issue.

In the USA, Paypal recently started offering business loans to its users. It perfectly displays the use of AI as the user’s movement of funds in their account acts as a form of credit control. The applications simply identify the regular payments from various accounts and use that to extrapolate the average funds users receive in a year. That helps the system automatically decide whether to grant loans and how much if so.

Lending software also minimizes human error in accounting

Good lending apps link up with other accounting and monitoring software that makes it much easier for the lender to handle the loan repayments over their lifetime. Poor bookkeeping can be a great inconvenience for both the lender and the borrower. Poor record keeping often leads to problems such as some installments not being reflected in the borrower’s account even after being paid. This leads to the loan balance appearing higher than it actually is. Linking the loan servicing software to the financial system within the processing office will prevent occurrences like that.

Final thoughts

The whole idea behind the use of AI is a win-win situation for the lender and the borrower. The lender is able to get information about a borrower very fast, verify their creditworthiness effectively and provide funds much faster. Lending software creates a process with minimal human labor required helping borrowers fairly access credit with the utmost convenience.

Vit Arnautov is the Chief Product Officer at TurnKey Lender, a company creating intelligent AI-driven solutions for alternative lenders. With more than 10 years of experience in IT, Vit is happy to share his expertise with striving entrepreneurs and anyone else it can be helpful for.